Last year was an eventful one for the mortgage market in Poland. Below is a comprehensive summary of the key trends.

Don't miss the latest news from the financial market in Poland and useful mortgage tips.

2025 Poland Mortgage Market Report: Volumes, Interest Rate, and Creditworthiness

2025 Poland Mortgage Market Report: Volumes, Interest Rate, and Creditworthiness

Last year was an eventful one for the mortgage market in Poland. Below is a comprehensive summary of the key trends.

Mortgage for Renovation in Poland — How to Finance the Purchase and Renovation of a Property with One Loan

Mortgage for Renovation in Poland — How to Finance the Purchase and Renovation of a Property with One Loan

A mortgage for renovation in Poland (also called a purchase + renovation mortgage) is an increasingly popular solution offered by Polish banks. It allows you to finance both the purchase of a property and the renovation or finishing works with just one home loan.

How to minimize the Polish mortgage cost?

How to minimize the Polish mortgage cost?

When signing the mortgage agreement with a Polish bank, you agree on multiple conditions, including the estimated total cost of the mortgage. Does it mean that you are obligated to repay the specified amount to the bank? No, it doesn't, and we will show you multiple methods of cutting the mortgage cost available in Poland.

Mortgage market report - 2024

Mortgage market report - 2024

Please accept our apologies. We've been busy recently, so the summary of the Polish mortgage market from last year is coming a bit later than usual. Let us then get on with it.

Polish Mortgage in 10 Steps

Polish Mortgage in 10 Steps

Do you plan to take a mortgage in Poland? Our guide should help you to understand what steps await you in the process. To make your life easier, we recommend taking all these steps with us, via a free mortgage brokerage service.

How to make an early repayment of the mortgage in Poland?

How to make an early repayment of the mortgage in Poland?

Most of our customers ask us at different stages of the mortgage process about what the early repayments of the loan look like in Poland. Hence, we decided to break it down with proper analysis.

Mortgage market report - 2023

Mortgage market report - 2023

As every year, the time has come to summarize the situation in the mortgage market in the previous year and to outline the developments that will be affecting the current year. 2023 was a year of rebound in the mortgage market, partially stimulated by governmental programs. Let's break it down into pieces.

"Safe Mortgage 2%" - brief analysis.

"Safe Mortgage 2%" - brief analysis.

As we are already a month into the governmental program addressed to first-time property buyers, we gathered enough data to analyze it further.

PPK - what it is, and why you should have participated.

PPK - what it is, and why you should have participated.

PPK ('Pracownicze Plany Kapitałowe') is a retirement saving program enforced by the government three years ago. In our opinion, among many missed programs our current government has established, the PPK makes the most sense. Read more to find out why.

Mortgage market report - 2022

Mortgage market report - 2022

The time has come to summarize the situation in the mortgage market in the previous year, and to outline the developments that will be affecting the current year.

How to save thousands of PLN on your mortgage with one simple adjustment?

How to save thousands of PLN on your mortgage with one simple adjustment?

In Poland, one of the main price-shaping factors in the mortgage is the amount of upfront the customer can pay in advance.

Transfer of the mortgage to a cheaper bank - how does it work in Poland?

Transfer of the mortgage to a cheaper bank - how does it work in Poland?

Recently, many mortgage owners could've been offered a change from variable to a 5-year fixed rate. While it was and still is an option to consider, there is also an alternative way to address the current situation in the market, with potentially more tangible and long-term savings in mortgage cost.

Fixed rate vs variable rate - market update.

Fixed rate vs variable rate - market update.

It's been only four months since we have analyzed the differences between the fixed and variable rate mortgage. Nevertheless, the situation on the market changed so rapidly that we have decided to look at the subject once more.

Mortgage in Poland - fixed rate vs variable rate.

Mortgage in Poland - fixed rate vs variable rate.

Until recently not all banks in Poland were offering a mortgage with a fixed rate - this changed due to a recommendation issued by the Polish Financial Supervision Authority, and now each big bank in Poland does offer this type of mortgage. Let's analyze what the market offers.

Poland's mortgage market summary.

Poland's mortgage market summary.

The year 2020 is over, and even though its outcome will most probably affect the market for longer, let's summarize what we already know.

Zaliczka or zadatek, and why you should know the difference.

Zaliczka or zadatek, and why you should know the difference.

The upfront payment is one of the most crucial aspects of the deal when buying a property in Poland, or elsewhere. On the Polish market, there are two types of upfront - zaliczka or zadatek. They differ significantly, and you must be aware of those differences to avoid any unpleasant surprises.

A comprehensive guide to mortgage in Poland.

A comprehensive guide to mortgage in Poland.

For all who consider buying a property in Poland via a mortgage, we prepared a comprehensive guide about the subject. We hope it will help you understand the process and decide whether or not you wish to join more than 2 million households owning property in Poland via a mortgage.

How much does the mortgage in Poland cost? The price breakdown.

How much does the mortgage in Poland cost? The price breakdown.

Understanding the actual cost of the mortgage might be challenging as there are many factors to it. Let’s analyze them for you one by one.

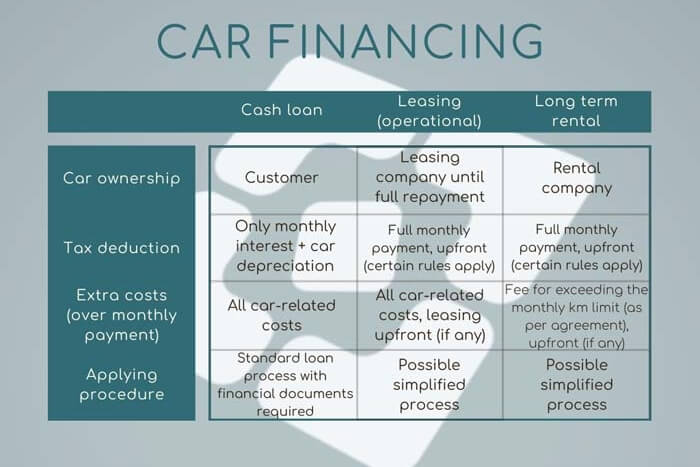

Buying a car in Poland, should I go with loan, leasing or rental?

Buying a car in Poland, should I go with loan, leasing or rental?

Here is a brief comparison of the popular ways to finance the purchase of a car in Poland.

A short guide to buying an apartment in Poland via mortgage

A short guide to buying an apartment in Poland via mortgage

Buying an apartment in Poland does not have to be complicated if you are well prepared for the task.

How much of mortgage down-payment should I pay in Poland?

How much of mortgage down-payment should I pay in Poland?

If you are planning to get a mortgage in Poland, sooner or later you will hear about "wkład własny" or "wpłata własna". How does it work?

Early repayment of the mortgage in Poland - is it possible?

Early repayment of the mortgage in Poland - is it possible?

As many of our customers plan to repay their mortgage sooner than the original period in the mortgage agreement with the bank, we decided to explain to you how it works.

Credit score in Poland - how to build it?

Credit score in Poland - how to build it?

Let’s talk about the credit score in Poland.

Creditability in Poland - how do the banks calculate it?

Creditability in Poland - how do the banks calculate it?

One of the most important aspects of getting the mortgage, or any other loan, is your creditability. What is it and how do the banks calculate it?

Contact form