22/09/2020 by Jakub 0 Comments

Buying a car in Poland, should I go with loan, leasing or rental?

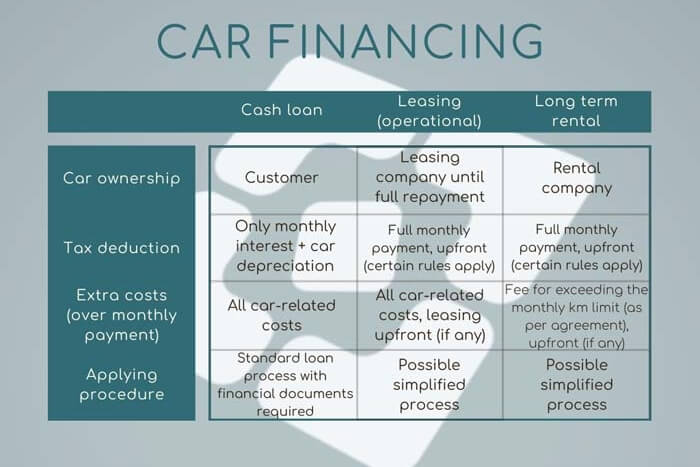

Here is a brief comparison of the popular ways to finance the purchase of a car in Poland.

In 2019(Q1-Q3), registered car dealers in Poland sold 410,8k new vehicles, most of them got purchased via leasing, not with cash (data by Polish Automotive Industry Association). The ratio is more balanced when it comes to second-hand cars, but still, a significant amount of cash deals are financed via bank loan anyway. It's confirmation of the long-term trend on the market as more and more customers decide to use outside financing rather than their savings for the car purchase. One of the reasons for that is that the market offers plenty of options and most of the customers can find a solution that matches their needs.

To help you find the one for yourself we decided to create a comparison of the three most popular options at the moment - cash loan, operational leasing, and long-term rental. The main differences occur in the application process, ownership status, taxation, the structure of the cost, as well as the maximum age of the car and product length, hence we will focus on these issues.

Application process.

The cash loan is obtained directly at the bank and is subject to standard bank procedures. When applying for it you apply only for the given amount of money without connection to the purpose you will use it for. Given that, the bank analyzes only your financial situation and decides if they can offer the amount you request, hence you will need to provide financial documents, whether salary confirmation or your company's accounting documents.

This process might be simplified when it comes to leasing or rental. In most cases, when you buy/rent a car the leasing/rental company will not ask for financial documents, but rather check the credit-score databases like BIK, BIG InfoMonitor, or KRD, and other of that sort. When you buy a second-hand car or new car with a value over 150k zlotys, the process similar to a cash loan might appear, as owning such vehicles poses more risk for the leasing company. The decision on what applying path to follow is always up to the analyst assigned to the case.

Ownership status.

When buying a car using a cash loan, you become the sole owner of the vehicle, as the bank only gives you money and does not ask for what you need it. This means you can manage the car freely and without any restrictions that occur in leasing or rental.

The leasing company remains the owner of the car until the debt is repaid fully. Due to that, you cannot manage the car the same way you can with a cash loan, you need to service or insure it as per the leasing company criteria, you cannot make any permanent changes to it without permission or take it abroad without first informing the leasing company and getting the document confirming owner agrees for that. Also, the users of the car must be acknowledged and agreed upon by the leasing company. The same applies to rental, however, issues like service and insurance can be part of the deal as the responsibility of the rental company. Lastly, when the renting period is over, you do not become the owner of the car unless it was agreed otherwise beforehand.

Taxation.

Please keep in mind that subject as delicate and complicated as taxation is best to discuss in detail with your accountant. Nevertheless, we are happy to explain the general rules connected to the products we analyze here.

With a cash loan, becoming the sole owner of the car matters also when it comes to taxation, as the car you buy this way can be registered as your company's possession and be giving you a tax premium due to depreciation. It does not apply to the operational leasing or rental. On the other hand, you can include only the interest part of the loan's monthly installment in your company's sheets as the cost.

In leasing or rental, the whole monthly payment can be considered a cost of your company, but different rules apply here depending on if you are a VAT taxpayer or if you use the vehicle for business purposes only. Moreover, in 2019 the government has set up a rule, that leasing or rental costs for a car with a value exceeding 150k zlotys (or 225k for an electric car), cannot be fully included in your company's financial sheet. Also, the initial upfront for the leasing or rental can be considered the business cost, which gives opportunities for tax optimization. As advised previously, we believe these issues should be discussed and thoroughly analyzed with your accountant.

The structure of the cost.

Cash loan pays up only for the cost of the vehicle purchase, the insurance, service, and all the other expenses related to owning a car have to be covered separately. Of course, you can apply for a loan higher than the cost of the vehicle itself, as mentioned previously the bank is not interested in the allocation of the money it lends you this way and will lend as much as your creditworthiness allows. However, please keep in mind that the interest rate for the cash loan nowadays starts from 7% per year. On the other hand, with a cash loan, you can buy a car without VAT, which is not the case with operational leasing or rental. There is another type of leasing, kind of hybrid, called financial leasing, used by company owners buying a second-hand car from a private seller without VAT, but as it is not one the most popular products, we do not analyze it here, feel welcome to query us directly for details of it.

When buying a car with leasing, also insurance, service, and other costs of maintenance are covered by the customer, unless negotiated otherwise. What is different from the cash loan is that the leasing company will provide you with strict requirements about OC/AC, service, etc. Another cost that does not occur with the loan is the upfront, which you have to pay in most of the cases, and usually, it starts from 5-10%. On the other side, leasing also offers the option of a higher last installment, it can be agreed at even 35% of the car value, which is used to lower the monthly burden throughout the leasing period. Lastly, the interest rate is lower than the loan, it can be even around 1% per year depending on the case.

The structure of the cost seems least complicated with the rental, as in most cases you can have it all included in the monthly payment, insurance, service, even tires with storing them for you. On top of that, you might pay an extra fee, if you will exceed the yearly km limit determined in the agreement. Rental also might mean upfront - the more upfront you pay the lower the monthly payment would be. As you are not buying the car, but renting it, it is not possible to assess the yearly cost of the capital, you are paying just for using the car or for the value it is losing while you are using it, not for obtaining it. However, looking at the market, the 36-month deals for the smallest cars like Fiat500 without upfront and insurance included start from around 600 zlotys net per month, while in the same scenario for Mercedes E-class you should be prepared for circa 2300 net monthly.

Maximum age of the car/product length.

The cash loan has no limitations when it comes to the car age, for the reasons we explained in the previous sections. As for the maximum length of the loan itself, currently, banks offer up to 10 years (12 in specific cases).

The construction of the leasing is different. The main rule is that the age of the car and period of the leasing cannot exceed 8, 10, or 12 years when combined (depending on the leasing company regulations). In some cases, like a specialistic or historical car, it can be altered. This rule applies to second-hand vehicles. The leasing for a new one in most cases cannot be longer than seven years. Overall, leasing is often individually negotiated due to customer needs and also based on the customer's situation.

The long-term rental is made specifically for new cars, but still few companies offer second-hand options. The period of the rental goes up to 5 years.

We hope you find this article helpful. Feel welcome to query us for more details.

Best regards,

Loan-brokers.pl Team

Any content provided on this page is to be considered information only. It is not legal advice or a replacement for legal advice. The information posted here by the Loan-brokers.pl team is accurate and current to the best of our knowledge as of the date it is posted, but website users should be aware that laws and their application change frequently, sometimes without notice. You shall be fully responsible for any consequences resulting from your use of the page. Any reliance upon any information shall be at your sole risk.

Comments

Leave a comment